If the bank categorizes your business as high-risk, you comprehend the extra effort required to engage with any company. You need a merchant account, and when you have a high-risk merchant account, you acknowledge the risks and the importance of maintaining good credit. New business owners often find high-risk merchant accounts, like highriskpay.com, somewhat challenging to grasp. In this article, we’ll delve into the fundamentals and provide insights into high risk merchant account at highriskpay.com

What Is a High-Risk Merchant Account?

When your business falls into the high-risk category, it indicates that your company conducts a higher volume of transactions than the average business. High-risk industries perceive your business as being more susceptible to risks, hence the classification.

A high-risk merchant account, offered by highriskpay.com, helps mitigate chargeback fees, fraudulent charges, and other costs incurred by merchants. Such accounts are more prone to rejection, especially for online businesses. This is because online businesses need a physical presence, making banks and transaction companies more cautious.

High-risk merchant accounts, like those offered by highriskpay.com, exist to provide businesses with added protection against online fraudsters.

READ ALSO: How2Invest – Best Strategy Guide for Empowering Your Business

Why Do You Need a High-Risk Merchant Account?

You need a high-risk merchant account, like the one provided by highriskpay.com, if your business history involves high chargebacks, fraud, poor credit, or the risk of customer fraud. Specific industries, such as subscription services, the adult industry, and more, require these accounts to safeguard themselves against customer fraud.

Understanding the Costs Associated with High-Risk Merchants like highriskpay.com

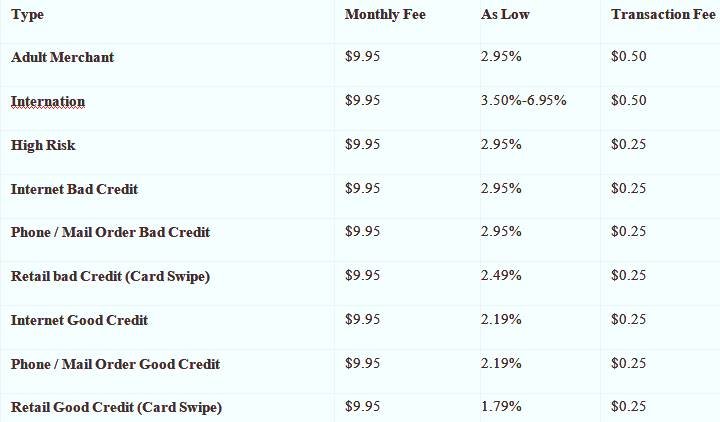

Before you decide to transition to high-risk payments, it’s crucial to understand the associated rates and charges. Here are the key figures to be aware of:

If you’re contemplating a move to high risk pay, it’ll be beneficial to have an understanding of the rates and charges. These are the figures you should be aware of.

- Credit Repair Merchant Account

- Continuity Subscriptions Merchant Account

- Ecommerce Merchant Account

- Dating App Merchant Account

- CBD Merchant Account

- Bad Credit Merchant Account

- Adult Merchant Account

- Debt Collection Merchant Account

- Online Pharmacy Merchant Account

- MLM Merchant Account

- High Volume Merchant Account

- Firearm Merchant Account

- Nutraceutical Merchant Account

- Tech Support Merchant Account

- Sportsbook Merchant Account

- Travel Merchant Account

- Tickets Brokers Merchant Account

- Dropshipping Merchant Account

- Startups Merchant Account

Documentation Required for Applying for a High-Risk Merchant Account

To qualify for a high-risk business account, you’ll need to provide the following documents:

- Valid driver’s license

- Proof of insurance coverage

- Personal Identification Number (PIN): A confidential code used at ATMs and drive-through facilities. The PIN should not contain personal information. This requirement may be waived if there is a single owner.

- Corporate registration information, including incorporation articles, partnership agreements, limited liability company articles, and documents confirming your business’s operational status and financial transaction capabilities.

How Does a High-Risk Merchant Account Work?

A high-risk merchant account serves as a contractual agreement between a business owner and a financial institution. This agreement allows business owners to accept payments from customers through payment processing systems, including debit and credit card processing. The fees for these services depend on transaction volume, transaction size, and the level of risk.

The choice of services and requirements varies from one bank to another. Some banks may require a few years of business operation before granting a high-risk merchant account, while others may consider your application if you’ve experienced fraud.

Factors Leading to the Classification of Business Owners as High-Risk

Business owners are classified as high-risk based on several factors:

- High transaction volume: Businesses with an increased number of transactions (e.g., over $20,000 per month or more than 500 per transaction) can be labelled as high-risk.

- International sellers: Companies that market products internationally, particularly in high-risk countries, may be classified as high-risk.

- New business owners: If you’re a new business owner with limited or no transaction history, you could be considered high-risk.

- High-risk industries: Even with a clean record, you might be labelled as high-risk if your business operates in high-risk sectors, including subscription-based services, online gaming, the adult industry, and travel agencies.

- Low credit scores: Low personal or business credit scores can lead to a high-risk classification.

Industries Classified as High-Risk Merchants, like highriskpay.com

It’s essential to determine if your business falls under the high-risk category when setting up your venture. High-risk industries include:

- Adult

- Gambling

- eCommerce

- Online dating

- Gaming

- Debt collection

- Vape shops, E-cigarettes, and CBD

- Multi-Level Marketing

- Subscription services with recurring payments

Benefits of a High-Risk Merchant Account

A high-risk merchant account offers several advantages:

- Global coverage: High-risk merchant accounts allow you to connect with customers worldwide and accept payments in various currencies.

- Chargeback protection: These accounts help safeguard against chargebacks, enhancing your reputation as a merchant.

- Acceptance of credit and debit card payments: High-risk merchant accounts enable you to accept both credit and debit card transactions, providing flexibility for customers.

- Enhanced security: Your customers’ data is better protected with high-risk merchant accounts, offering higher security standards.

- Customer satisfaction: By providing secure payment options and local currency exchanges, you can offer a satisfying shopping experience to your customers.

For more information about high-risk merchant accounts and their benefits, contact highriskpay.com.

If you have any further questions or need assistance, feel free to reach out to us. We are here to help!

Conclusion

Understanding the concept of high-risk merchant accounts is crucial for businesses in industries prone to higher risks. These accounts provide essential protection against chargebacks and fraud, enable international transactions, and enhance customer satisfaction. By comprehending the fundamentals and requirements, businesses can navigate the complexities of high-risk merchant accounts and continue to thrive in their respective sectors.

FAQs (Frequently Asked Questions):

- What is a high-risk merchant account? A high-risk merchant account is designed for businesses with a higher risk of chargebacks, fraud, or poor credit. It offers added protection to safeguard against these risks.

- Why do specific industries require high-risk merchant accounts? Industries like adult entertainment, online gaming, and debt collection often require high-risk merchant accounts to protect themselves from potential fraud by customers.

- What documents are needed to apply for a high-risk merchant account? To qualify for a high-risk merchant account, you typically need to provide documents like a valid driver’s license, proof of insurance, and corporate registration information.

- What benefits does a high-risk merchant account offer? A high-risk merchant account allows businesses to accept payments worldwide, protect against chargebacks, and provide secure credit and debit card payment options.

- How can a high-risk merchant account enhance customer satisfaction? High-risk merchant accounts offer increased security, local currency exchange options, and detailed information about payment methods, ensuring that customers are satisfied with their transactions.